As lumber supplies continue to be a challenge in the pallet industry, it is always a good idea to keep in mind competition for one’s raw material source. This article provides an overview of the wooden crosstie market from a pallet industry perspective. Because of the pressure on low-grade hardwood supplies, particularly hardwood cants, I am focusing attention here on the wood markets and the interaction of demand for both crossties and pallets.

What’s In A Crosstie?

As most pallet manufacturers know, particularly those in the eastern 2/3s of the country, the railtie industry is the biggest competitor to the pallet industry for low-grade hardwood cants. The center or heart of many hardwood logs can be boxed into either a railroad crosstie or a pallet cant. Other industries that use low-grade hardwood include oil field board roads, mining timbers, and truck beds, but ties are the biggest user of low-grade hardwoods after the pallet industry.

In addition, the railroad industry needs significant quantities of ties, and they have to plan ahead. Tie treaters buy green ties long before railroads use them for track maintenance or construction. Crossties are primarily made from hardwood trees, mostly species of oak. About 6-8% are softwood, usually Douglas fir. Ties are dried either by air seasoning in stacks open to the air for several months or by the Boulton process, where ties are treated in heating cylinders immersed in liquid creosote and under vacuum to drive off excess moisture. As much as a year may lapse between the time a green tie is cut and a treated tie is delivered to a railroad. According to the Railway Tie Association, dry ties average approximately 40 to 50% moisture on a dry wood basis. Because railroad specifications are more stringent than most pallet cants, a higher grade of log is required for crossties. For the reasons mentioned here, railroads are willing to pay more for a green tie on a board footage basis. Since railroads will pay more, they are going to get their share of logs from the supply line. If it comes down to competition, the tie market will pay enough if necessary to outbid the pallet industry.

Ties are treated with creosote under pressure for preservative impregnation. Treatment standards are stated in the American Wood Protection Association (AWPA) standards. Most ties are treated to a gauge retention of seven pounds per cubic foot of wood. Refractory species, such as white oak and Douglas fir, are typically treated to the point where they refuse to absorb additional chemicals. Gauge retention is the amount of creosote injected into a charge of wood divided by the volume of wood in the charge. Some wood species are refractory or resistant to treatment. The average creosote retention in ties is in the range of six-eight pounds per cubic foot.

Expansion of the railroads in the late 1889s and early part of the 20th century helped make creosote the preferred treating chemical for a good portion of the treated wood market through WWII. It continues to be the chemical of choice for crossties.

Ties vary in size. The most common size is 7-inches by 9-inches by 8.5-feet long with a volume of 3.72 cubic feet. The average tie contains about 20 pounds of creosote. Not too many years ago 6×8 ties were common, but the 7×9 has become dominant in the market. Switchties are often longer because of the difference in their application requirements. The standard railroad tie is 8-1/2 feet long with some railroads still using a limited number of nine foot long ties.

The Demand for Ties

While some studies have been done of the wooden pallet industry, it is a very diverse and scattered industry making precise estimates difficult. By contrast, the railtie industry is handled by a very limited number of suppliers serving an even smaller number of customers. Since the railroads keep good statistical numbers, the industry’s demand for new crossties has been a fairly reliable number.

One of the main functions of the Railway Tie Association (RTA) is to collect industry production and demand numbers and project future demands. Any estimate includes an element of uncertainty, but the RTA has a forecasting model that has proved to be fairly accurate. Because of the lack of statistical information on the production of wooden pallets, the wooden pallet industry is more difficult to track.

In addition, the pallet industry faces the issue that pallets are made from a wide variety of species, dimensions, and quantities. A wide spectrum of hardwoods and softwoods can be interchangeable under certain circumstances. Recycled pallets can often be substituted for new ones, a potential that is not duplicated for crossties. Because smaller scragg logs can be processed into pallet lumber but would often not make a tie, the pallet industry has much more flexibility in acquiring cants.

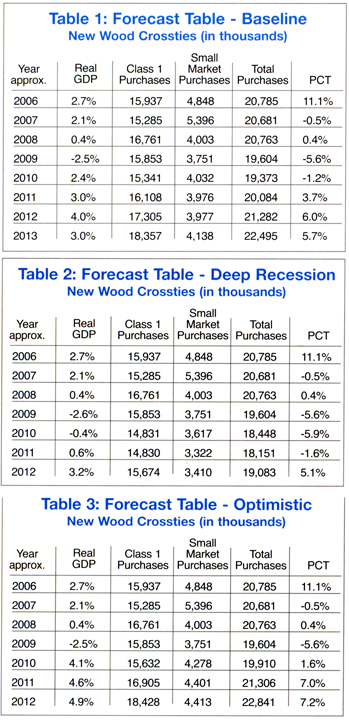

An article in the January/February issue of Crossties entitled Looking to the Future provides projections of the demand for railties for the next few years. Table 1 provides the baseline forecast for Class 1 and small market crosstie purchases according to the RTA’s model. The model uses the real gross domestic product as an overall forecast of the economy, an important element in this forecast. The baseline scenario that RTA projected for the next four years contains quite a bit of optimism, with a number of caveats.

The baseline forecast projects that the 2010 tie demand will suffer only mild softening from 2009. The final tally for 2009 is that 19.6 million new wood ties were purchased by all railroad market segments. The 2010 forecast will require 19.4 million ties, about a 1.2% decrease from 2009. To put a little historical perspective on these numbers, I can recall when the railtie market was closer to 12 million ties a year. About 20 years ago, Industrial Reporting published Crossties for the RTA. In those days tie demand was around this 12 million annual figure.

The RTA published two other tie demand estimate scenarios, one that incorporates another downward recessionary leg and one a more positive scenario. Table 2 provides deep recession forecasts. It uses a 0.4% drop in real GDP in 2010, a modest 0.6% growth in 2011, and a return to a stronger economy with a 3.2% growth in 2012. Table 3 provides a more optimistic forecast based on 4.1%, 4.6%, and 4.9% growth in 2010, 2011, and 2012. Since nobody knows for sure what direction the economy will take, these three estimates cover the range of prospects that the RTA projects for the next three years. Regardless of which alternative is considered, all of them suggest that railties will continue to be a major competitor to the pallet industry for hardwood cants. As the economy improves, the demand for ties should pickup. More certainly, the demand for pallet cants is expected to improve. The pallet industry will continue to compete with crossties for raw material.

It is worth noting that the RTA indicates that in an informal poll of its members most of them appear to favor the more middle of the road baseline scenario. The bottom line is that unless hardwood production improves as fast as the cant and tie demand improve, tight supply conditions are likely to continue. Right now pallet cant supplies are in the tightest market they have ever experienced. Many people expect the pallet demand to improve, but the future of hardwood cant supplies remains very uncertain.

Further Reading

The last time that the Pallet Enterprise featured treated wood products was an overview of the overall treated wood industry in March, 2006, in an article entitled Treated Wood Overview – A Product Constantly Changing. Any reader who wants a more comprehensive coverage of chemical treatment alternatives is referred to this piece, which is available online by searching www.palletenterprise.com on “crossties”.