According to a recent poll of pallet industry leaders, most believe the current economic downturn will be short-lived.

The majority (74%) predict that pallet demand will recover by the end of the second quarter of 2024, if not sooner.

An informal poll of 50 pallet industry leaders who participated in a recent webinar for the Western Pallet Association suggested that the current slump in pallet demand will recover by next summer. This was an unscientific, self-selected poll of pallet manufacturers, recyclers and brokers.

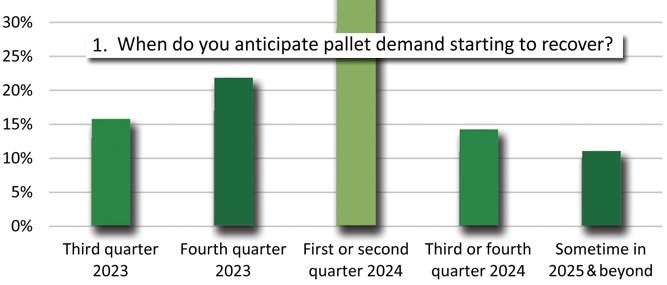

The least popular response is 2025 and beyond (6 out of 50 for 12%). This sentiment follows the common perception that any recession that does occur will be mild. Economists, by and large, contend that we are not in a recession. But it may not feel that way for the trucking sector, which has been in the dumps since last year, and the pallet market, which has been trending downward over the past year. For full response details, see Graphic 1.

Looking at the major economic indicators, the results are mixed. Housing starts boasted a strong recovery to start this summer. Housing starts rose 21.7% in May to a seasonally adjusted annual rate of about 1.63 million, the greatest monthly gain since October 2016. Hiring slowed but remained sturdy in June as U.S. employers added 209,000 jobs despite inflation, high interest rates and nagging recession fears. Retail sales grew in May above economists’ expectations. Consumers are still fueling the economy, although they are expected to pull back significantly at some point as household debt levels rise and savings get tapped out.

When asked, “When do you anticipate pallet demand starting to recover?” The most popular response was the first or second quarter of 2024 (18 out of 50 responses, or 36%). This tracks with what freight expert Craig Fuller of Freightwaves recently predicted in a webinar when he stated that he doesn’t see any signs of a significant uptick in demand for freight capacity in 2023 and that spot rates are not ‘out of the woods’ yet. Current data from FreightWaves National Truckload Index shows some slight upward trends in the spot rate. But Fuller said that he doesn’t expect spot rates to continue rising for the rest of the year. Freight is typically a leading indicator of pallet activity.

The response that came in second was the fourth quarter of 2023 (11 out of 50 responses for 22%). Maybe these companies are hoping for a Christmas bounce. But retail sentiment overall anticipates a down holiday season with deep discounts and freebies offered to get consumers to spend. The ability of consumers to spend is limited by inflation and high debt loads. Only 1/3 of consumers are paying off their credit cards at the end of the month. An increasing number are using credit cards to pay for essential items, such as food. Total American household debt rose by $148 billion in the first quarter of 2023 to more than $17 trillion. Credit card balances usually drop in the first quarter of a year. But credit card balances remain at $986 billion, about the same as the holiday season at the end of 2022. Also, student loan repayments will resume by the end of August without relief from Congress or the Supreme Court, which could hamper the spending power of Millennials.

Somewhat surprisingly, 38% of respondents expect pallet demand to recover this year. That’s 16% anticipating a third quarter rebound and 22% expecting a fourth-quarter recovery. But the exact amount of growth was not explored.

While nobody knows for sure what will happen, most economic experts stated early in the year that any recession would take place in the third or fourth quarter. So far, the U.S. economy remains in positive territory even though pallet shops are down 10-30% from recent historic highs in total sales. Most experts believe any recession will be short-lived. That’s hopefully the good news. The bad news is that the recovery may be gradual and take longer than other recent recovery periods.