In a previously published Pallet Enterprise article (Material Use and Production Changes in the U.S. Wood Pallet and Container Industry: 1992 to 2006, June 2009), we provided the results of a series of studies that investigated the use of new wood by the pallet and container industry. As we mentioned in the article, the use of new wood is only one of the changes in raw material use affecting the industry. Trends in the use of recovered wood materials may be more significant than changes in the use of new wood. In this article we seek to provide a more complete picture of wood sources and use in the industry by documenting trends in recovery, repair, and remanufacturing activity.

Virginia Tech, in collaboration with the USDA- Forest Service, has completed five studies of wood use in the U.S. wood container and pallet industry since 1992. Each of the five studies utilized a mail survey of firms that were primarily or secondarily involved in the production of pallets and/or containers. Survey data were then extrapolated to estimated totals based on the number of employees in the industry as reported by the United States Department of Labor, Bureau of Labor Statistics. We attempted to keep the methods and questions used in the studies consistent to ensure that the results were comparable. However, some changes were necessary.

In particular, the most recent study (i.e., 2006) utilized a different definition of the industry because of the switch among federal agencies from the Standard Industrial Classification (SIC) system to the North American Industry Classification System (NAICS) for grouping and categorizing industries. Additional details can be found in the previous article.

Recovery, Repair and Remanufacturing

Over 450 firms, representing more than 590 production facilities, provided information about their business activity in 2006. Approximately 57% of the firms reported that new pallet production was their primary source of revenue. Recovered, repaired, and/or remanufactured pallets were the primary source of revenue for 25% of the firms. Regardless of the primary source of revenue, over one-half (55.5%) of responding firms were involved in pallet recovery, repair, and/or remanufacturing. Clearly, pallet recovery is no longer the peripheral activity it may once have been. Rather, the profitable utilization of used pallets has become an integral, if not primary, part of the business plans of many firms in the industry.

Industry-wide, the production of used (i.e., recovered, repaired and/or remanufactured) pallets averaged 208,375 units per firm in 2006. Firms received or purchased an average (mean) of 394,160 cores and a median of 102,000 cores in 2006.

The average (mean) number of cores received varied by region (Figure 1). Firms in the Northeast region averaged the highest number (593,090 cores per firm) and firms in the Midwest the lowest (284,160 cores per firm). The total number of cores received by firms in the industry is estimated to be 460.7 million in 2006.

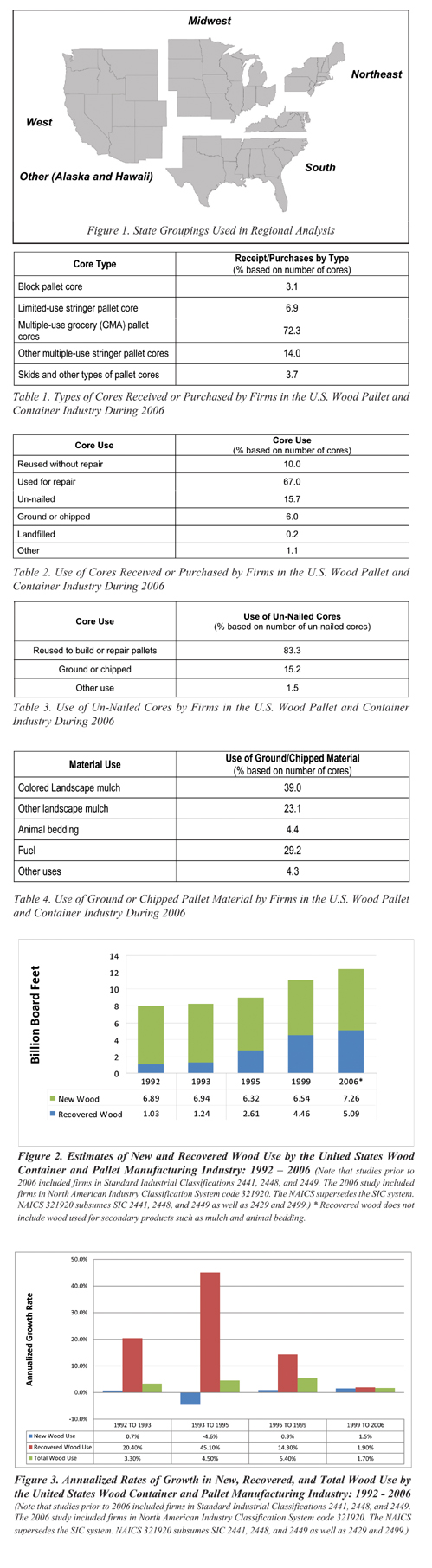

Nationwide, the majority of cores received (72%) were of the multiple-use grocery type (Table 1). Other multiple-use stringer pallet cores accounted for 14% of the total received while block pallet cores accounted for only 3% of the total. In each region, multiple-use grocery type pallets accounted for the majority of cores with proportions ranging from 80% in the Northeast to 63% in the Midwest. The proportion of limited-use stringer pallet cores received was largest in the Midwest at approximately 14%. This proportion was 6% or smaller in each of the remaining regions.

Firms were asked to indicate how the cores they received in 2006 were utilized. As indicated in Table 2, the majority (67%) were repaired. Almost 16% were un-nailed and 10% were reused without repair. We found that less than one-quarter of 1% of the cores received were landfilled. Over 93% of the firms that received cores were involved in pallet repair/remanufacturing. The remaining firms likely are reselling cores to firms that repair/remanufacture pallets or to pallet users.

National patterns regarding the use of cores were generally mirrored in the individual regions. In each region, the used for repair category accounted for the greatest number of cores. Firms in the West used three-quarters (75%) of the cores received for repair – the largest proportion of any region. Firms in the Midwest region repaired the smallest proportion of cores received (61%). The proportion of cores un-nailed was largest in the Midwest at 22%. The proportion of cores reused without repair ranged from approximately 8% among firms in the West to 12% in the Northeast.

Table 3 provides details of the use of the almost 16% of cores that are un-nailed. As would be expected, the largest portion (83%) of the parts was reused in repairing or remanufacturing pallets. Some un-nailed parts and/or sections of parts are unusable. We found that the equivalent of 15% of the un-nailed cores fell into this category and were subsequently ground or chipped. The equivalent of 1.5% of the un-nailed cores was utilized in ways other than repairing/remanufacturing or grounding/chipping. Nationwide, approximately 82% of firms that un-nailed cores also repaired/remanufactured pallets. The remaining firms may sell parts to other businesses.

Following the use of cores further, we investigated how ground or chipped material was utilized. As shown in Table 4, colored landscape mulch is the most common use of ground material at the equivalent of 39% of ground/chipped cores. Almost half (47%) of the firms that grind or chip cores used material for colored mulch. The equivalent of 29% of the ground/chipped cores was used for fuel and 23% were used for other (uncolored) landscape mulch. The smaller but potentially profitable animal bedding market accounted for the equivalent of 4.4% of the ground/chipped cores.

The utilization of ground/chipped material varied with regional markets for the resulting products. For example, 85% of ground/chipped material was used for colored landscape mulch in the Northeast while only 15% was used for this product in the West. Firms in the West and Midwest used the largest proportion of ground/chipped material for fuel (69% and 35%, respectively) while use for fuel in the Northeast (4%) and South (8%) was much lower.

Recovery Trends

Comparing the results of the five studies conducted since 1992 provides some insights as to how pallet recovery, repair, and remanufacturing have changed, or not changed, in 14 years. For example, the proportion of multiple-use grocery type cores received by firms in the industry has grown from 61% of the total received in 1992 to 72% in 2006. The proportion of cores repaired has ranged from 61 to 70% over the period. The proportion of cores un-nailed was found to be 14% in 1992 and 16% in 2006. The proportion of cores reused without repair was found to be approximately 15% in 1992, reached a low of 8% in 1999, and grew to 10% in 2006. Each of the studies that asked about landfilling cores has found that the proportion was less than 1%.

Landscape mulch (colored and uncolored) has been a significant use of ground/chipped cores and un-nailed parts since the original 1992 study. In 2006, mulch products (colored and uncolored) accounted for over 60% of ground material. Use for fuel has decreased from 53% in 1992 to 29% in 2006, perhaps as firms found markets for more profitable products such as colored mulch.

The Big Picture

By combining information regarding the use of new wood and the use of recovered cores, we get a picture of how the U.S. wood container and pallet industry is utilizing a mix of these sources of material to serve its customers. Figure 2 provides our estimates of the use of new and recovered (used) wood by the industry from 1992 to 2006. Two trends are evident. First the total amount of wood material (both new and used) utilized by the industry increased steadily between 1992 and 2006. We estimated that the industry utilized 7.9 billion board feet of wood in 1992. In 2006, this figure grew to 12.4 billion board feet.

The second trend evident in the data is the increasing importance of recovered material to the industry. In 1992, recovered material accounted for 13% of the wood material utilized by the industry. This grew to 41% in 2006. In fact, the use of new wood material by the industry increased by only .37 billion board feet over the period covered by the studies. The large increase in overall wood use (4.43 billion board feet) primarily is the result of increased use of recovered wood. However, there is an indication that large increases in the use of recovered materials (as seen in the 1990s) may be leveling-off. Between 1999 and 2006, recovered wood use grew by a relatively modest .63 billion board feet and the proportion of total wood use that was recovered grew by less than one percentage point.

Figure 3 illustrates the pattern of wood use growth experienced by the wood container and pallet industry. New wood use has grown comparatively little since 1992 and at rates lower than growth of both overall wood use and real U.S. Gross Domestic Product (GDP). In contrast, recovered wood use has changed significantly. During the early and mid-1990s, the use of recovered wood grew dramatically – not only to support an overall increased demand for wood by the industry but as a substitute for new wood material. The rate of growth in recovered wood utilization slowed in the last one-half of the 1990s but remained much higher than growth in new wood use. By the first one-half of the 2000s, the industry appeared to have exhausted large gains in recovered wood utilization and growth rates for both used and new wood more closely reflected overall wood use increases. With the exception of 2002, wood use growth rates were lower than real U.S. GDP growth rates. With the slowing of economies worldwide, we expect to see wood use by the U.S. container and pallet industry to remain stagnant in the near future.

(Editor’s Note: Robert J. Bush is a professor with the Virginia Tech department of wood science and forest products; Philip A. Araman is a research team leader and scientist with the U.S. Forest Service Southern Research Station in Blacksburg, Va.)