The success of CHEP around the globe and the impressive growth of the EPAL pallet pool in Europe demonstrate that there is money to be made in pallet pooling. But that doesn’t mean that every pool concept will work or even be profitable. For years, leaders in the U.S. white wood pallet industry have discussed the development of an industry cooperative pallet pool that holds to high quality standards and is regularly monitored to ensure compliance. One of the most promising proposals in a long time is the Pallet Industry Management System (PIMS), which is an industry cooperative pool being championed by a number of major pallet companies, including a number of major players in the National Wooden Pallet & Container Association (NWPCA).

The PIMS model is just in the concept stage at this point. But recent economic analysis by a group of experts indicates that the model could save pallet users money in the long run. The NWPCA along with money from the Pallet Foundation commissioned a survey to analyze the business case for the PIMS model. Dr. Charles Ray and Dr. Judd Michael of Penn State University presented their findings at the Orlando NWPCA meeting. Their analysis was based on a survey of 103 pallet companies, data from the Recycle Record and other sources.

Many industry leaders agree that the pallet recycling industry needs to develop an industry-wide answer to pallet rental options, including a quality standard to meet changing customer demand. One of the major dilemmas remains the quest for quality while customers continue to switch suppliers for nickels per unit. Although this is nothing new, the increase in warehouse automation, the development of a major all-plastic pallet pool in iGPS, and an improving CHEP rental pool, suggest that pressure is mounting on white wood to respond. At the same time, the white wood pool isn’t getting any younger.

There appears to be no easy answers. But PIMS is a bright idea that has garnered some support from major pallet users. PIMS is a certified and inspected pallet quality standard combined with a management system and network of pool operators designed to offer major customers an option to traditional pallet rental models. The PIMS calls for regular quality inspections to ensure the highest quality standard, similar to the approach used by EPAL in its European pallet pool.

Although there have been numerous attempts to discuss similar plans in the past, none have developed the traction that appears to be building for PIMS. However, this does not mean that the success of PIMS is a foregone conclusion. There remains a lot that has to be done for this dream to become a reality. Some skeptics don’t believe that PIMS stands a chance to succeed. At the same time, many forward-thinking leaders in the industry feel that momentum is building to develop an answer to the challenges facing the white wood pool.

Clint Binley, the outgoing chairman of the NWPCA, said, “It (PIMS) will not happen today. It will not happen tomorrow. But it will happen down the road.”

Based on the results of the three-month study, the PIMS computer simulation projected a total pool size of 24 million pallets by year five and an average new pallet cost of $18 per unit. The model assumed 6-24 months of use before repair (averaging 18-21 months) and a fairly high 8-10 trips per pallet per year. CHEP averages around four trips per year. Dr. Ray suggested that the high core value, especially in the early years of the PIMS ramp-up, gives DCs a significant economic incentive to turn pallets as quickly as possible compared with the typical rental pallet scenario.

PIMS has four major types of participants in the model. This includes the pallet manufacturer, the shipper or product manufacturer, the retail DC and the pallet recycler.

Dr. Ray’s analysis shows a good business case for the model, but the big challenge is the funding of the system. The cost just to purchase the pallets alone could run $432-500 million over five years. This does not include any administration and software development, maintenance and other system costs.

Dr Ray said that the overhead of PIMS, including presumably the software, is covered by a fee that will be established by PIMS. This fee is pennies per pallet, so in a sense the cost of the pallets does cover PIMS administration.

The Penn State PIMS model does not include inspection costs. Pallet repair costs were included in the model, and accounted for a portion of the recycled pallet costs to customers for each trip.

Initial projections indicate that pallet manufacturers would experience the highest profit potential early in the development cycle while pallet recyclers would see increased profits over time that would average out to be higher than the profit potential for pallet manufacturers.

The current PIMS model calls for the customer to underwrite the cost of the system, which means that the pallet user would have to be willing to pay a fairly high trip cost up front. Over time, the cost would drop significantly to be more in line with what CHEP charges. Dr. Ray suggested that the average per trip cost could drop to a fairly steady rate in the $8 range within nine months of launching the program.

The emergence of pallet rental over the past 20 years has changed customer attitudes toward expensing pallets. Many large companies don’t want to buy a pallet. They would rather expense pallets as a service cost by leasing it instead of an outright purchase. Getting customers to agree to buy a high-dollar pallet asset may be a hard sell. Although this is what many companies used to do, CHEP has been effective in convincing companies that they “don’t want to be in the pallet business.”

Industry leaders behind PIMS believe that if case studies can prove the business model in the real world, some major pallet users will be willing to switch. The primary benefits for the product manufacturer or shipper is a high quality pallet and the development of a viable wood pallet alternative to traditional rental options.

The biggest benefit may rest with the retail DCs that will enjoy revenue generated by selling used PIMS pallets. Evidently, Costco’s representative expressed interest in the PIMS model at the recent NWPCA meeting.

Dr. Ray said, “The retail DCs would benefit greatly from this system, because of the large revenues generated from pallet core sales.” PIMS proponents are looking for a retail pull-through strategy, much the way that CHEP used the power of big retailers to encourage shippers to use blue pallets.

The current model projects sizeable revenues for everyone in the supply chain except for the product manufacturers. See Chart 1.

Dr. Ray was quick to point out that the PIMS model is still being tweaked. At the NWPCA meeting, some industry leaders suggested changes to make the model even more appealing to the initial shipper and product manufacturers. These shippers are critical to making the system work although they have voiced a strong desire to see a legitimate competitor to CHEP, and the jury is still out about the long-term viability of iGPS.

Customers want quality and price. These two forces are frequently at odds with each other requiring trade offs. But that doesn’t have to be the case over the long term. One thing is clear from the recent analysis done by Drs. Ray and Michael, there is a strong economic case to be made for a system similar to EPAL in the United States. The new pallet math seems to be Innovation+Investments over Time = Higher Profits for All.

Chart 1: PIMS Profit & Revenue Projections

Pallet Manufacturers

• Pallet pool of 24 million block pallets built over five years.

• $61 million in profits over five years.

Pallet Recyclers

• 220 million recycled pallets sold back into the custom pool over five years.

• $292 million profit generated over five years for participating recyclers.

• Low repair rate, especially in early years.

Retailers/Distribution Centers

• About $670 million in revenue generated from PIMS pallet core sales over five years.

Source: NWPCA Presentation and interview with Dr. Chuck Ray.

Revisiting the Grocery Industry Pallet Study 20 Years Later

A group of grocery industry leaders met in 1989 to discuss the future of the fast moving goods supply chain and palletization. They looked at the future of the “GMA” pallet, especially various economic models. The committee included many of the top food producers in the country as well as major retailers. Representatives included members of the Food Marketing Institute, the Grocery Manufacturers of America, the Produce Marketing Association, the Private Label Manufacturers Association, the American Meat Institute, and the National-American Wholesale Grocers Association.

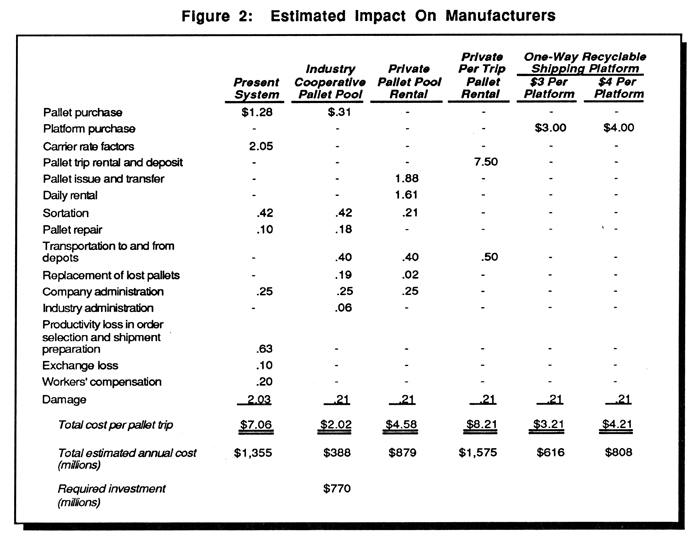

Looking back at the past, the committee analyzed costs in the grocery supply chain. Principal among the study’s findings were an overall pallet system cost of nearly $2 billion, almost half of which was determined to be the result of product damage, carrier inefficiencies, productivity losses and time allocated to sort and repair pallets. This figure translated to a pallet-related cost of approximately 16 cents per case, or $10.11 for every loaded pallet moved completely through the distribution cycle.

The grocery committee also examined options to pallet exchange. The results of the 1989 survey is shown in Figure 2. At the time, an industry cooperative pool was envisioned to be significantly cheaper in terms of total cost than a private rental pallet pool. Recent analysis by Penn State involving the PIMS model comes to the same conclusions.