The biggest driver of cost and the key factor in determining the quality of a pallet are the same thing. And that is the lumber used to manufacture or repair a pallet. Key factors include the wood species and the board thickness. Knowing some basics about pallet lumber can make the end product better either in terms of cost or performance.

Initially wooden pallets in the United States and Canada were almost exclusively made from new wood, mostly low-grade green hardwood or either green or kiln dried low-grade softwood. Until the mid-2010 decade, hardwood was dominant in the eastern and Midwestern states. Softwood was dominant in the western states, much of Canada and in all of Europe.

Basically wooden pallets are made from the kinds of lumber that are plentiful and when possible native to any particular part of the world. The most important factor is finding a lumber source that is fairly low in cost. Other important factors include lumber species that are strong enough to handle the applications and increasingly having lumber that is dry enough to avoid mold growth.

Historical Developments, Transition to Softwoods

With the exception of the western part of North America, in the United States low-grade hardwoods have been the dominant pallet lumber source since the inception of palletization. While oak and mixed dense hardwoods are often preferred, softer hardwoods are often used in regions where they are dominant. But all of this started to change several years ago as other low-grade hardwood using industries experienced demand growth causing a strain on supply. From crossties to board roads, flooring and industrial timbers, all of the competing sectors got hot at the same time. And they all have bigger pocketbooks than the pallet industry. This left pallet companies scrambling for supply.

The pallet industry is fortunate that it can use a wide variety of species, dimensions, and even qualities of lumber. This makes the pallet sector more flexible than many other industries when it comes to adjusting to market changes. Pallet companies may have to adjust their specifications when it comes to species, dimensions, and qualities. But the industry has two software systems (Pallet Design System™, and Best Pallet™) that can provide engineering information on flexible lumber sources, dimensions, and qualities, as well as fasteners and pallet performance specifications. When the hardwood supply crisis hit in the mid 2010s, the pallet industry literally could not find enough hardwood to handle the customers who had been using hardwood pallets. So, there was a major shift from hardwoods to low-grade softwoods, including southern yellow pine (SYP) in the Southeast and Canadian spruce pine fir (SPF) across the northern states.

Up until that point many pallet customers had considered hardwoods to be stronger than softwoods. They had sort of a mental block to softwoods for pallets. To many of them, hardwood meant strong and durable (hence the name “hard”), while softwood meant weak and less desirable. While this can sometimes be true, dense hardwoods may be stronger, some softwoods can be reasonably strong as well, particularly SYP.

Because softwoods are often kiln dried before being sold to the eventual user, they have proven to be less prone to molding. Going into the 21st century, phytosanitary regulations to prevent the spread of insects from one part of the world to the other brought on the concept of heat treating exported pallets and pallet lumber. Bringing the internal temperature up to the regulated requirement for a specific period of time may have killed many insects or larvae, but it also tended to draw the internal moisture to the surface, making surface conditions more ideal for generating mold. Thus, many pallet customers found it desirable to buy kiln dried lumber, which both cut down on mold and satisfied the phytosanitary requirements. This is the reason that the hardwood shortage in the second decade of the 2000s made softwood pallets a more desirable alternative.

Regardless of many engineering issues, the bottom line typically drifts toward cost. While pallets have stayed competitively prices over the years, pallet users are typically always looking for a better deal. Because lumber pallets are both strong and competitively priced, they have held their position as a preferred unit load option when compared to other materials. While some alternatives to a pallet have been introduced, the wooden pallet still does the job at a competitive price.

Most pallet users still lean toward wooden pallets as a good way to both ship and store their products. The bottom line is that the pallet industry is more flexible today when it comes to lumber species than it has ever been in the past. It typically comes down to lumber cost, acceptable lumber species available locally and past buying habits. Most buyers are reluctant to change their unit load pallet buying habits unless there is a really good reason to do so. Recent upward swing in softwood lumber pricing due to tariffs and market pressures have led some who previously opted for softwoods to look again at hardwood material for cost relief.

Global Wood Market Impacts

A recent market report from Wood Resources Quarterly (WRQ) emphasized recent softwood global buying habits. Softwood lumber prices trended upward in early 2017 with North American prices hitting a 13-year high. Chinese imported prices are said to have increased by 13% in the last 18 months, and Japanese prices have moved modestly higher.

Western pallet manufacturers have been acutely aware of the impact that China has had on the low-grade softwood export market over recent years. Western Canada has developed the Chinese market for lower-grade softwood and has reduced somewhat the quantity of softwood material sold into the western United States. There has been a significant increase in the quantity of low-grade SPF softwood in eastern Canada for the northern states and SYP for the pallet industry in the southern states. Prices for U.S. softwood lumber jumped during the first four months of 2017 to hit a 13-year high in April. According to the WRQ, many of the grades rose more than 20% from April 2016 to 2017.

According to the WRQ, “prices for imported softwood lumber to China have been in a steady upward trend during 2016 and 2017 with the average price in March 2017 being 13% higher than 18 months earlier.”

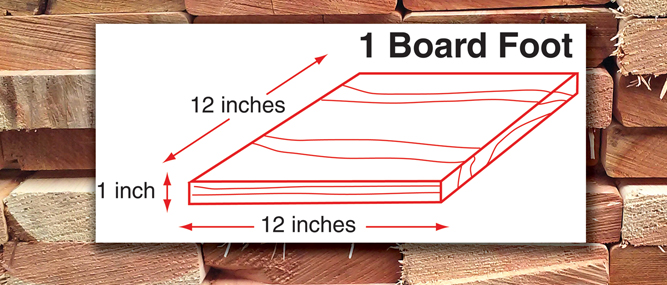

What’s in a Board Foot?

When anyone considers the board footage in a pallet, caution should be exercised. It is often said that “beauty is in the eye of the beholder.” It can be said as well that “board footage is in the mind of the individual.” The basic definition of a board foot remains 1 foot x 1 foot x 1 inch. Differences come mostly in how these dimensions are defined.

As anybody who has ever bought a board in a lumber yard knows, a 2×4 doesn’t measure 2”x4”. A softwood 2×4 is typically finished to 1-1/2”x3-1/2”. When I was a young man, I helped an older friend dismantle an old house. The dried studs in that house measured more than 2”x4”, which was typical for the 19th century.

Softwood pallets are typically made from resawn dimensional lumber. The lumber material is measured on a full dimension, e.g. 2×4 as 2×4, etc. Resawn pallet stock decking is measured on a full 1”, and stringers are typically measured as 2×4.

While softwood is sold on established nominal dimensions, rough green hardwood is usually bought and sold on a full count. A one-inch rough hardwood 4/4 board will typically measure 1-1/16”, or even 1-1/8” thick. A hardwood cant will similarly actually measure at least 1/16” over its scale. At one time hardwood warehouse pallets conformed with established hardwood grading rules. One-inch decking might be finished 13/16” and a two-inch stringer could be surfaced o 1-3/4”. Now, however, hardwood specs which call for 1” nominal decking and 2×4 nominal stringers may receive a wide range of actual dimensions depending upon the supplier and the circumstances. A one-inch deck board would typically be 3/4” or 11/16”, 5/8”, 9/16”, or even 1/2”. While many pallet manufacturers are careful to supply a customer what he wants and specifies, there is just so much variation in hardwood specifications.

Some pallet manufacturers buy cut stock or lengths of dimensional hardwood and figure footage in pallets in a manner compatible to the way they buy wood. There are so many different types of milling and sawing machinery and so many different ways of purchasing and cutting logs and rough hardwood that what seems reasonable to one pallet company may look like folly to another. If it causes confusion within the industry, just imagine the confusion it can bring to pallet purchasing.

For pallet manufacturers, conventional wisdom suggests using a pricing system based on all manufacturing elements, including lumber. It is not wise to price strictly on a board footage basis. Make sure to cover the costs of lumber and nails, as well as including any scrap material such as sawdust and other wood residue. Include all of your labor costs and don’t forget your company overhead.

For pallet users, specify your pallets in terms of actual dimensions, not nominal ones. Do not settle for anything less than what is specified. Make sure that your specification is precise so that both you and your suppliers understand thoroughly what you want. Have your incoming pallets carefully inspected when they arrive. Possibly the most important thing is to establish a relationship with dependable suppliers on whom you can count.

So, while a board foot is based on width x length x thickness, the numbers that are used for these dimensions can vary according to buying habits, cutting practices and cost models.