CHEP recently discussed its plastic pallet tests underway with Costco as well as how it will come to a decision regarding whether or not to commercially launch a plastic pallet for Costco suppliers. Those tests were sparked by Costco’s announcement in late 2019 that it would be requiring plastic pallets in the near future. At this time, iGPS is the only regular plastic pallet provider to Costco.

Industry analysts and insiders are watching with interest as to whether the switch to plastic will come to fruition, and additionally, if the second largest global retailer successfully makes the shift, to understand the likelihood of other retailers also following suit. Let’s dive in.

Costco Is an Important and Unique CHEP Customer

CHEP emphasized that it has a 20-year relationship with Costco, and at present, it accounts for around 10% of CHEP USA pallet issues. Lara Nadar, CHEP North America president, pointed out at the briefing that Costco’s growth has consistently outpaced other big box providers and has been a “key driver of new business wins” for the rental giant.

Nadar underscored that the Costco supply chain is different from those of other retailers. (In other words, even if plastic makes sense for Costco, it won’t for different retailers. We’ll return to this thought later.) Rather than being a conventional fast-moving consumer goods supply chain that involves a case pick at the distribution center, Costco employs a full pallet cross dock model. Costco’s supply chain turns faster and is more controlled than those of other retailers. When you are trying to build a business case for pallets that cost three times as much as wood, such factors are important.

CHEP’s Plastic Pallet Design and Pilot Testing

CHEP designed its RFID-enabled plastic pallet in-house. It is UL approved for fire safety and ISO 8611 rated for loads up to 2800 pounds. To date, the test has involved 80,000 plastic pallet issues, and involving suppliers from various categories that account for 30% of Costco volume. Nadar said that suppliers participating in the test have been positive on the pallet’s permanence and have accepted a pricing premium.

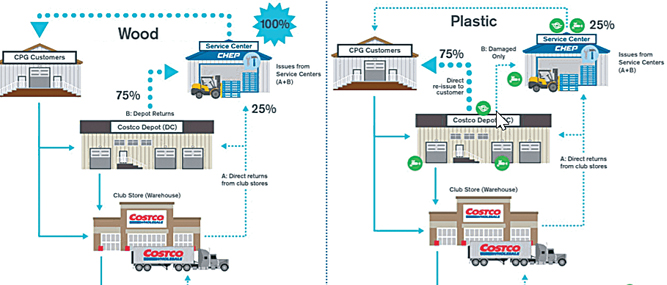

Because the damage rate is predicted to be very low, empty pallets can be shipped directly from Costco to a product supplier without having to go through a CHEP service center. As a result, this saves the time and expense of off-site pallet inspection. Costco has agreed to sort the pallets. Nador suggests that 25% of the pallets would go back to a service center to facilitate rebalancing of the pool.

CHEP’s Decision Process

According to Joaquin Gil, Brambles senior vice president of financial planning & analysis, the decision on whether to proceed with the investment in Costco plastic pallet will be based on three decision criteria: expected financial returns at full implementation, Costco’s commitment to product and operational requirements, and finally, the acceptance of plastic pallets, including CHEP commercial terms and conditions, by Costco suppliers. The latter, according to Gil, includes acceptance of premium pricing to wood and compensation charges (for loss).

If CHEP rolls out plastic pallets to Costco, at an estimated cost between $450 and $700 million, then existing wood pallets used to support Costco suppliers would be gradually reallocated to non-Costco supply chains over the course of the three-year conversion, saving the company roughly $150 to $180 million in wood pallet purchases.

But CHEP emphasizes that it will only proceed if a plastic pallet launch for Costco makes financial sense. “We are proud of our long and mutually successful partnership with Costco,” said Graham Chipchase, Brambles CEO. “But while we strive to meet our customers’ needs, it’s also important that we continue with a disciplined approach to capital allocation.

CHEP indicated that the move only makes sense because of Costco’s unique supply chain, and it would not currently be a fit with other retailers. “It is important to note the loss rate in anything, but low loss rate lanes would require a price premium that would make plastic pallets commercially unviable,” Gil said.

Will CHEP Say Yes to Costco Plastic?

Several experts believe that CHEP will go ahead with plastic pallets, saying that it will achieve the required profitability requirements. Additionally, none of the experts believe it is likely that CHEP would walk away from 10% of its U.S. business over a three-year wood phase-out.

“We estimate price rises will be achievable and relatively immaterial, as they will be diluted across a customer’s total pallet expense and a three-year time frame,” wrote Samuel Seow, vice president at Citi Research. While concerned that the size of the investment would dampen the pooler’s current “underlying momentum” he believes that “plastic will have a positive effect on earnings, while its impact on capex and balance sheet will be limited.”

Ex-CHEP and iGPS executives, both highly experienced with plastic pallet applications, believe that it will be a profitable conversion for CHEP to make, if they are successful in achieving the full cooperation needed to limit dwell time and leakage.

Will Costco Plastic Be the Thin Edge of the Wedge?

Costco has been a trend setter regarding pallets. It was early in the game to eliminate pallet exchange in favor of rental, and then again in requiring block pallets. And by the way, I am not aware of other retailers who followed Costco’s lead on a block pallet only requirement.

But what about plastic? Will acceptance lead to other retailers following its lead on plastic? It is an important question for the pallet industry, as well as for CHEP watchers, given its U.S. inventory north of 100 million wooden pallets. Our experts were decidedly divided on the likelihood of a broader grocery ripple effect.

Scott Riely, formerly senior VP logistics for Brookshire Grocery Company and now an independent senior supply chain consultant, doesn’t see a Costco conversion having a big impact on the rest of the grocery sector, citing concerns such as fire safety, different product ordering patterns and the reluctance of smaller companies to participate in rental because of cost. “Potential barriers such as these for inbound logistics will make it slow for industry to adapt,” he suggested. Even with a UL fire rating, he speculates that insurance carriers might still find plastic pallets to be an issue.

Other experts are more bullish on the possibility of a Costco plastic conversion having broader ripple effects. One believes that once suppliers start using plastic pallets they will be hooked and will wish to expand usage. “It’s the savings across the board in logistics, hygiene, damage, ease of use, presentation, etc.,” he commented. “Once you have rung the bell,” he said, referring to experience with plastic pallets, “you can’t unring it.”

“Plastic eliminates 80% of the current plant cost associated with wood,” another expert noted, also believing that a Costco conversion would have broader implications for the grocery sector, and which might not involve a significant pricing upcharge, once all the savings are recognized. He cited other potential drivers such as increasing wood prices, expanding adoption of warehouse automation, pallet-enabled sensors and hygiene.

From the CHEP perspective, plastic doesn’t make sense in other supply chains, a thought echoed by Riely, a grocery industry veteran. As some other experts note, however, there are trends at play that continue to support the introduction of plastic, and when Costco converts, the barrier to other conversions will be lowered. For my money, I don’t see much change in the market over the next few years resulting from Costco. I believe that other plastic pallet applications will continue to be targeted at particular niche applications. But to be certain, the conversion will be monitored closely by many, including grocery decision makers.