With so much uncertainty around the economy in 2023, pallet companies are faced with a choice. They can either continue to work on their business roadmaps, pressing forward with expansion and sales growth. Or they can pull back and focus on only their prime clients. Or they can pivot and adopt a different strategy. There are various shades of these approaches. But either way, you are going to have to decide: go full speed ahead, turn to another road, or pump the brakes?

A lot may depend on how long you believe a slowdown will last, if it occurs at all. While many companies are seeing slumping demand, others report stable customer orders. Another major issue is how your markets may be insulated from macroeconomic forces.

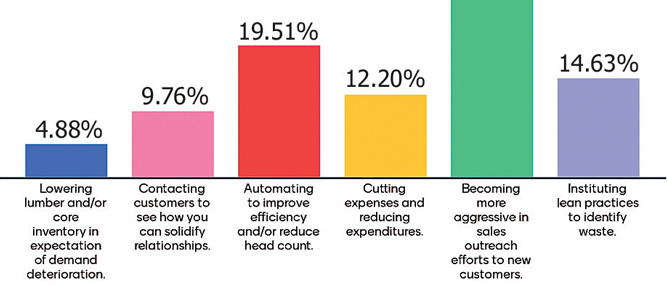

At the recent Western Pallet Association (WPA) annual meeting, the crowd was asked to share their responses to a looming economic slowdown or recession. It was asked, “What are you doing to prepare for uncertain economic times ahead?” Respondents could pick more than one answer.

By far the most popular response is to become “more aggressive in reaching out to new customers.” During the pandemic, pallet companies were so busy that they were turning away new customers. Most were not aggressively seeking to poach customers. As the economy slows, pallet companies will become more aggressive. This means pallet companies will have to defend their flanks and work to improve services and communication with existing customers. What are you doing to cement and improve long-term relationships? Are you establishing new sales goals based on the changing pallet demand landscape? Interestingly, only 9.76% of respondents were contacting existing customers to see how they could solidify relationships. This is easy to overlook, and yet it is easy to do. Some companies don’t do that because they are afraid of rocking the boat. But in this changing environment, your competition is going to be reaching out to your customers. Shouldn’t you be doing everything you can to reassure them that you are a valued partner?

The second most popular strategy is to “Automate to improve efficiency and/or reduce headcount.” Equipment suppliers are still backlogged, and it takes time to automate. Labor isn’t going to get any cheaper. That will be the last inflationary pressure to go back down. Without a serious recession or depression, wage costs will remain elevated. Another major factor could be comprehensive immigration reform combined with an aggressive new guest worker program. But there doesn’t appear to be any momentum in Washington, D.C. to truly address these challenges. The latest labor numbers remain strong. Manufacturing employment rose in January by 19,000 jobs. Currently, the manufacturing sector has almost 13 million workers, the highest amount since 2008. The average hourly earnings of production and nonsupervisory workers in manufacturing are up 5.3% compared to the same time last year.

The third most popular response was to “institute lean practices to identify waste.” Now is the time to keep a close eye on lumber and core inventory while working to become as efficient as possible. For many companies, this approach involves automation combined with removing bottlenecks and developing smart data capabilities. Through the years, Pallet Enterprise has developed a lot of articles on lean business practices, strategies and ideas. Check out the website (www.palletenterprise.com) to see what you have been missing.

Below are a few key questions to consider when it comes to lean business principles. How do your production workers know that they are meeting company goals and objectives? Are there visual reminders to reinforce this mindset? What activities do your workers dread doing? Why? What things do your production workers spend precious time looking for that could be moved closer to his/her workstation? What actions could be automated to reduce wear and tear on workers? How can you better mine existing data to improve customer demand forecasting? If you could dream up one piece of equipment that is not on the market, what would it be?

Despite the fact that material costs are a significant drain on cash flow, only 4.88% said they plan to reduce lumber and/or core inventory to prepare for demand reduction. Maybe they have grown a lot over the last few years, and they want a slower pace to keep from wearing out workers. Maybe they are happy with current business levels and don’t want to take on debt to expand. Whatever the reason, they are going to wait and see what the future holds.

Even though material costs are a huge drain on cash flow, only 4.88% said that they are going to lower lumber and/or core inventory to prepare for demand reduction. Many pallet companies are building inventory as material becomes cheaper. But they are also being careful not to get too much inventory. To get rid of excess supply, some of the larger mega recyclers are selling off cores. The lumber supply situation has greatly improved across the country, although the hardwood sector is in a tough situation as much of its grade demand has reduced, especially from Asia. Some pallet companies are keeping orders up just to keep their suppliers viable.

So, what should your strategy be? Perhaps you pull back a little and reallocate resources to more profitable clients, or you decide to try to add another shift instead of more buildings and equipment. Maybe you decide to focus on improving your operations so that you are ready for the next upturn. Maybe you take any lull in activity to dream about the future and plan for new technology being applied to this industry, such as Artificial Intelligence (AI) or vision systems. If you are considering how this technology could change pallet operations, read the article on page 48.

Regardless of your strategy, it needs to be your strategy. You don’t want to just respond to the market because then you are held captive to its pressures. So, what’s your strategy?