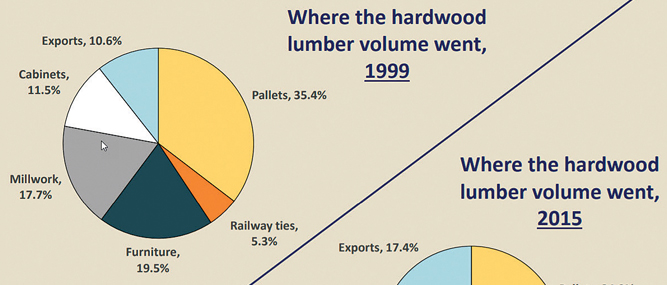

The accompanying pie chart was part of a presentation given by Matt Bumgardner, a research forest product technologist with the U.S. Forest Service Northern Research Station, at a conference a little over 18 months ago.

Actually, William Luppold, an economist with the Forest Service, and Matt Bumgardner have updated the chart, and the updated version is what appears on this page.

The Enterprise interviewed Bumgardner briefly to learn about changes in the hardwood lumber industry since the presentation he delivered at the Future of the Hardwood Lumber Industry Conference in November 2016.

The most notable trend, since he prepared that presentation, is that exports continue to be a bigger proportion of where hardwood lumber ends up, commented Bumgardner. “Exports are continuing to take a bigger piece of that pie,” he said.

Last year was a record year for hardwood lumber exports, noted Bumgardner. In fact, exports have climbed somewhat steadily since bottoming out in 2009 and have surpassed the highs set just a few years earlier.

“Part of the reason why exports are so important,” he pointed out, is that in addition to the demise of the furniture industry, markets like cabinets and millwork have been down as the homebuilding market continues to recover.

Those two factors have impacted the hardwood lumber industry in recent years: the offshoring of the U.S. wood furniture industry, and the bursting of the housing industry ‘bubble’ in 2008-2009 that launched the American economy into the Great Recession.

In fact, domestic consumption of hardwood lumber by appearance applications (cabinets, millwork, flooring, and furniture) and industrial markets essentially has flip-flopped since about 2007-08. Appearance markets took 46% of hardwood lumber in 2006 while industrial markets consumed 43%. (Other markets consumed 11%.) In 2009, the shift was complete, as industrial markets consumed 54%, and appearance-grade markets, 36%. (Other markets got 10%).

It seems unlikely the U.S. furniture industry will be resurrected since it has largely gone offshore, agreed Bumgardner. Employment in that industry was over 129,000 in 2000, but it was in free-fall through 2009, and by 2016 it was a mere 32,627 – a loss of nearly 100,000 jobs. The best chance for success in the furniture industry is for companies that can carve out niches related to custom products, suggested Bumgardner.

Hardwood lumber production clearly has improved, but it is still “well below” the 1999 high water mark and even compared to 2001-2006. “Will it ever get back there?” asked Bumgardner. “Not in the near term.”

However, the housing market has definitely picked up, the homebuilders have made gains in recent years. Spending on private construction has increased seven years in a row for multiple-family housing, six for single-family homes, and five years for remodeling. “The trends are definitely there,” said Bumgardner. “It’s just pretty gradual.”

Prices for industrial hardwood products have been improving. “That’s for sure,” observed Bumgardner. In fact, they’re improved to the point in recent years that pallet manufacturers have had difficulty obtaining hardwood cants at favorable price points and have converted customers over to pallets made of softwood material.

As the pie chart illustrates, the most significant changes in hardwood lumber markets in the past 15 years or so have been the decline of material going into the furniture industry and increases in exports and material going into the railway tie market.