China’s appetite for wood from other countries has increased steadily the past 10 years. Imports reached nearly 290 million cubic meters roundwood equivalent in 2016 – nearly double the volume of imported wood products compared to 2006. The figures include all timber products and pulp and paper.

China’s exports of forest products have declined over the same period, which means more is being consumed within China itself. That’s a departure compared to the early 2000 years, when China’s exports of forest products were growing quickly, reflecting that Chinese industrial demand was being fueled by demand for exports – from countries like the United States as well as European nations.

The value of China’s forest products imports increased by more than 130% over the 10-year period, although it has dipped a bit since the peak of $41 billion (U.S.) in 2014.

Pulp and paper products accounted for 58% of imports by volume and 51% by value in 2016, while timber products made up the rest; the ratio has been roughly balanced since 2011. The fact that the total volume of exports is increasing while total value declines indicates a slight shift toward imports of less costly wood materials.

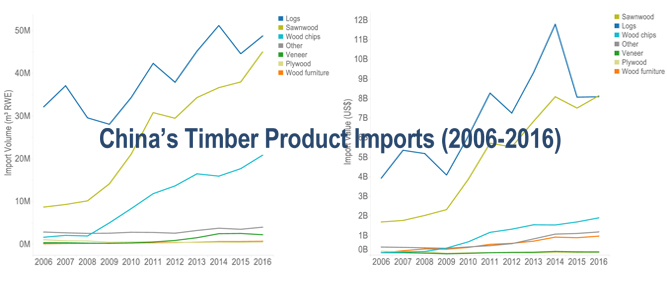

The accompanying chart was contained in China’s Forest Product Imports and Exports 2006-2016: Trade Charts and Brief Analysis Forest Trends July 2017, a report by Forest Trends Association, an environmental organization. (The report is available at www.forest-trends.org/documents/files/doc_5627.pdf.) It shows more details about China’s timber products imports.

China imported 122 million cubic meters roundwood equivalent of timber products in 2016. The top imports, in order, are logs, sawnwood, and chips. Together they accounted for 94% of the volume in 2016.

China imported 49 million cubic meters roundwood equivalent of logs in 2016 (valued at just over $8 billion U.S.), up slightly from the volume in 2015 but still below 2014. The value of its log imports has been flat in recent years, $8 billion in 2015 and 2016.

The proportion of imported timber products in log form has been in gradual decline from 71% to 40% from 2006-2016. The response of many of China’s biggest supplies of logs likely has been a factor. Countries like Russia, Myanmar and Laos have implemented bans on log exports or taxes.

Sawnwood now represents 37% of China’s total timber products imports. Sawnwood imports have grown 420% by volume the past decade to an all-time high of 45 million cubic meters roundwood equivalent in 2016 — valued at $8.1 billion.

The largest suppliers of softwood sawnwood to China are Russia and Canada, while the United States and Thailand are the largest suppliers of hardwood sawnwood.

The Oceania region, mainly Australia and New Zealand, is the largest supplier to China of softwood logs and hardwood logs.