In the 31 years since I started working with the wooden pallet and hardwood lumber industries many conditions have changed dramatically. For many years, changes were gradual; now they can come fast and furious at times.

This article is intended to be an overview of the changes that have occurred in hardwood lumber, particularly in this decade, and the direction in which the hardwood industry seems to be heading. Three sources of information used for this article include: the Pallet Profile Weekly, the Hardwood Review and George Barrett, and Dr. Bill Luppold of the U.S. Forest Service. Contact information is provided in Figure 1.

Hardwood Lumber History

Hardwood lumber, particularly lower grade, is the material of choice for many wooden pallets and containers. Some smaller, low-grade, pulpwood trees are cut on scragg mills specifically for pallet lumber. But a great deal of the hardwood pallet lumber is a by-product or downfall from higher grade hardwood production. Thus, when higher-grade hardwood markets trend lower, there tends to be less low-grade production as high-grade production decreases.

In the early days of hardwood pallets, sawmills typically had problems getting rid of low-grade material. Many log slabs and scrap materials were burned. Much low-grade hardwood lumber went into pallets as the product developed. More low-grade hardwood log centers went into pallet cants as crosstie demand lagged behind the earlier days of rapid railroad construction and poorer treating practices. The boom days of crossties had passed, but crossties still constituted a significant market for the hearts of hardwood trees. To this day, tie buyers can afford to outbid the pallet industry for raw material when supplies are tight.

Over the last century, hardwood flooring demand went through several cycles, peaked in the mid 1950s, and tailed off in the 1970s and early 1980s to the lowest numbers since the 1910s when wall-to-wall carpet took over the market. In the 1980s, flooring demand took off again on a long climb that carried it through the turn of the century into the 2000s.

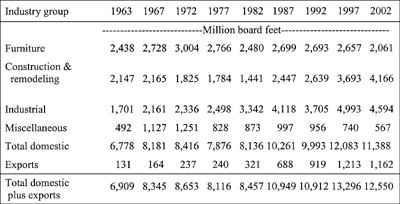

Dr. Bill Luppold of the U.S. Forest Service and Dr. Matthew Bumgardner of Virginia Tech recently wrote a paper entitled, Forty Years of Hardwood Lumber Consumption: 1963 to 2002. Their summary states: “An analysis of hardwood lumber consumption found that demand has changed dramatically over the past four decades as a result of material substitution, changes in construction and remodeling product markets, and globalization. In 1963 furniture producers consumed 36% of the hardwood lumber used by domestic manufacturers. Producers of hardwood construction and remodeling (CR) products accounted for an additional 32% of hardwood lumber consumption with the bulk of this volume being consumed by manufacturers of hardwood flooring. Between 1967 and 1982 hardwood lumber consumption by furniture producers remained relatively constant. By contrast, lumber demand by CR product manufacturers declined by 33% as carpeting was substituted for wood flooring. However, this decline in demand was countered by increased production of pallets and crossties, which accounted for 41% of hardwood lumber consumption by 1982. In the 1980s and 1990s, overall hardwood lumber consumption surged because of increased lumber use by pallet and CR product manufacturers. Since the late 1990s, furniture imports have increased while domestic furniture production has declined, thus furniture manufacturers accounted for only 18% of domestic hardwood lumber consumption by 2002. By contrast, consumption by the hardwood millwork, cabinet, and flooring sectors have continued to increase, partially offsetting the decreased consumption by the domestic furniture industry.”

Table 1 shows hardwood lumber consumption by industrial groups for census years 1963 to 2002 on five year increments.

Hardwood Flooring

When hardwood flooring demand dropped dramatically in the 1970s, the pallet industry continued its growth. There was a balance in a sense. Sawmills had to adjust their sawing and marketing practices somewhat to stay viable, but the market was able to adjust to take care of both the higher grade products and those that use lower grade hardwood materials.

Flooring started its gradual climb in the 1980s from its low of about 100 million board feet in the early 1980s to about 200 million bd.ft. by the end of the decade. It continued its climb with rapid increases in the middle of the 1990s to over 500 million bd.ft. by the year 2000.

While the North American flooring market grew, tastes changed more and more toward prefinished floors and all kinds of specialty floors. While unfinished strip flooring has survived, it occupies a less significant part of the market than it once did. Imported flooring has become more and more popular, particularly flooring from the Pacific Rim part of the world. Bamboo has become a fairly common flooring, which is technically not a wooden floor at all.

While domestic wood flooring plants continued their production into 2008, there is no doubt that domestic flooring shipments have leveled out the past few years, and there is concern that domestic flooring manufacturing is likely to struggle this year and maybe into the short-term future.

The hardwood flooring market has competed against wooden pallets in the lower-grade markets for hardwood lumber. While flooring focuses primarily on lumber supplies instead of cants, pallets utilize a great deal of hardwood lumber (4/4 through 8/4) in some markets as well. While flooring manufacturing fluctuates geographically, overall it has been a major competitor to pallets for hardwood material. That may continue to be so, but the domestic flooring market seems to be less dependent on local suppliers than it once was.

Furniture Exported In This Decade

In the late 1990s the furniture move toward the Pacific Rim was underway. At the turn of the century a massive movement of the hardwood furniture industry from North America to the Pacific Rim, particularly China, relocated many furniture factories across the Pacific. But the companies that had been in the United States typically have not bought the same quantities of hardwood lumber to manufacture their furniture now that they have relocated. To a great extent, they are building furniture using different wood and material sources than North American hardwoods. Hardwood log exports to the Orient have increased, but there has been a significant decrease in the overall production of North American hardwood mills due to the great drop in demand for higher grade hardwood lumber.

While 1999 was still a pretty good year for furniture hardwood production in the U.S., the massive migration toward China was underway. Today China, Vietnam, and other Pacific Rim countries do much of the machining and finishing. Most wood and wood products come into North America prefinished. Domestically we still do quite a bit of assembly and packaging on imported wood products.

Dr. Bill Luppold of the U.S. Forest Service confirmed our overall picture of the grade hardwood and furniture industries. Bill stated, “The number of hardwood mills is difficult to say with any precision, but the number has decreased considerably through the first decade of the 21st century.”

Recent Domestic Hardwood

Production and Trends

When talking with hardwood experts about the current market, their comments were similar. Reliable figures for 2007 production were not yet available, but Bill Luppold said he expects 2007 production to come in at about a half billion bd.ft. less than 2006, and he anticipates that this year will eventually show another decline of some half billion bd.ft., which could put us at late 1980 hardwood production levels.

Luppold stated, “The housing bust is global; international trade has been poor as well. We will see a fairly good rebound. It is primarily a matter of timing. Smaller operations (the Amish model) will benefit. After holding well for a while, kitchen cabinets are now off as well. The trend is toward an integrated supply chain. Suppliers of building products that can customize them and adjust to changing consumer requests are the wave of the future.”

One interesting thing I learned from my conversations is that, while North American hardwoods have a number of positive characteristics, the idea that we have a corner on hardwoods is not really true. Both Russia and Europe have substantial hardwood forests, particularly birch, beech, and white oak.

On February 15, George Barrett’s Hardwood Review provided an outlook for 2008. It stated that according to their research, “Hardwood lumber production at U.S. and Canadian sawmills declined 12.7% from 10.18 billion bd. Ft. in 2006 to an estimated 8.88 billion bd.ft. in 2007. In the U.S., reduced demand and heavy resistance to prohibitively priced logs pulled production down 11.3% to 8.35 billion bd.ft. in 2007.

The same Hardwood Review article stated, “Additional demand declines in several end-user markets, especially the cabinet and flooring industries, will cause further contraction in the North American hardwood sawmill sector this year…Most sawmills that haven’t already realigned their output to today’s lower demand will do so in 2008. We expect North American hardwood lumber production to fall another 12% to 7.81 billion bd.ft. this year. Sadly, a number of mills will close for good during that time.”

During the 1990s, new pallet production took a sabbatical on its long term growth trend, and the recycled wooden pallet market grew to the tune of about 20% a year. Pallets continued using large quantities of hardwood (see Table 1). The wooden pallet is the biggest user of low-grade hardwoods and occupies a significant place in the overall hardwood demand picture. During today’s slower economy, the pallet demand is reduced but is holding its own fairly well in many markets. Pallet activity varies according to the variations that occur geographically in manufacturing.

It is probable that hardwood pallets will continue to represent a large market into the foreseeable future. If the decline in overall hardwood production continues on its current path, a tight hardwood supply situation is likely to continue. In the past, the pallet industry has relied on growth in recycling, substitution of softwoods for hardwoods, and occasionally more imported pallet lumber to fill-in when hardwood supplies are tight. This decade has presented some significant hardwood supply issues for the pallet industry. While some reduction in pallet demand has helped relieve the lumber supply pressure that we experienced in recent years, the future is still not very clear. A prudent pallet manufacturer will work closely with lumber suppliers to build strong relationships. Both parties benefit when communication and understanding are both strong. The possibility of a tighter hardwood market during the next winter season is a definite possibility.

Figure 1

Sources of Hardwood Lumber Information:

The Pallet Profile Weekly

Jeff McBee 804/550-0323

Hardwood Review

George Barrett 704/543-4408

U.S. Forest Service

Dr. Bill Luppold 304/431-2700

Table 1.