Unprecedented. That’s a good word to describe the pallet industry over the past year. Pallet prices have jumped up so much, that the market inflation caught the attention of a Fox Business reporter.

In late November, Fox Business reporter Lydia Hu covered the significant increase in both new and used pallet prices since the pandemic began. She interviewed Dominick Davi, president of Greenway Products and Services, who spoke on the crazy market swings. He said, “I have been doing this for 25 years, and we have never seen anything like this.”

Fox Business quoted the Pallet Profile and Recycle Record in its report, pointing to the impact of high lumber and labor prices. You can see the complete Fox Business story at https://tinyurl.com/2p8h8fzx.

The inflationary pressure in the pallet market is our staff’s selection for the Story of the Year for 2021. And these trends lead one to ask, “Will the market return to normal in 2022?”

Let’s look at our basic pallet index number for a new pallet. Keep in mind this is for a delivered, hardwood GMA pallet with 5/8"deck boards & 13/8" stringers. Depending on the region, our prices ranged from $12 to $13.50 in March 2020 for a standard hardwood GMA. That same spec in October 2021 ranged from $15.25 to $21.50. Remember that softwood pallets have been much higher when lumber prices spiked earlier this year. Notice how the spread has grown larger too as local conditions can affect everything from wood supply to the ability of producers to find extra labor.

Not only have prices skyrocketed, but supplies are tight with limited capabilities to improve in the short term. 2021 saw extensive industry consolidation, particularly for recyclers as a few mega recycling companies went on acquisition sprees buying up core accounts and regional players. This means bigger pockets can corner the core market no matter the price. Competitive options, such as pallet rental, are facing their own supply challenges as customers keep pallets longer. Also, distribution centers and retailers are keeping more of the choice used pallets, which further depresses supply.

Dr. Mark White, professor emeritus from Virginia Tech and a widely recognized pallet expert told Bloomberg, “Pricing indexes on pallets doubled in the spring and the summer…What we are trying to do is get back to a balance. Most of the prognosticators are fingers cross saying that it will be mid-to-late 2022 before we get back to a proper balance.”

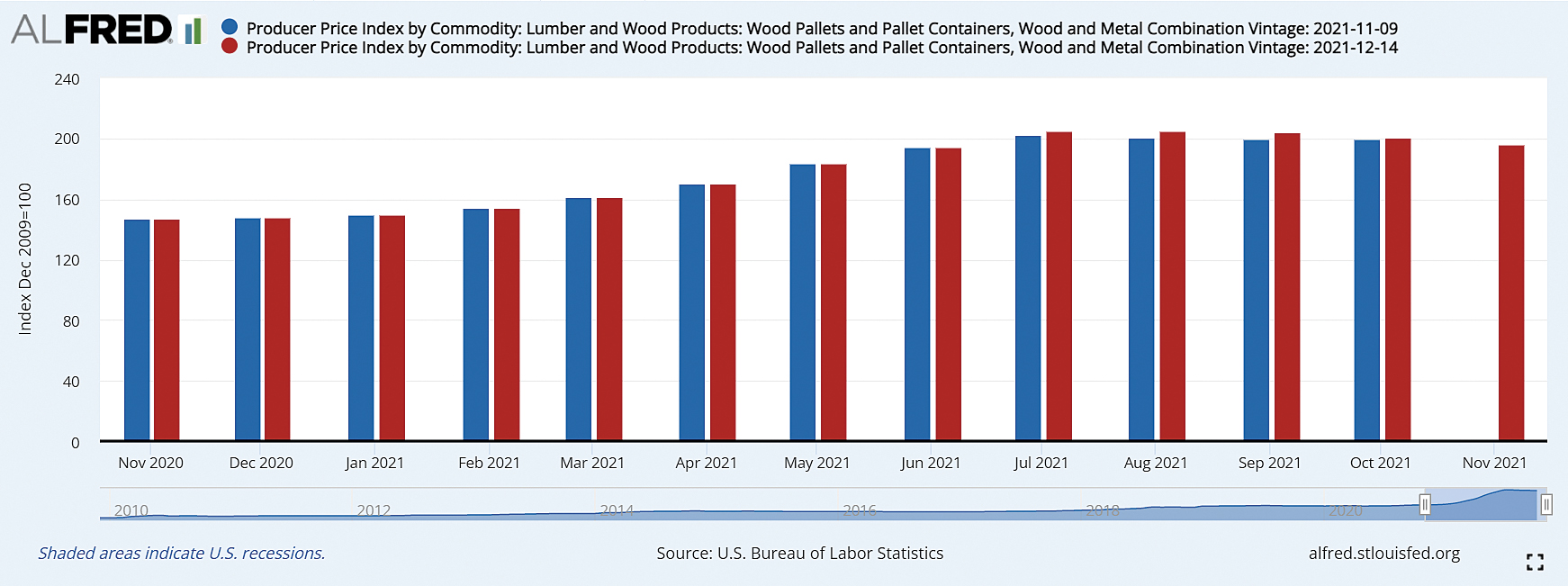

The Federal Reserve monitors pallet price movements as a sub-component of the producer price index. According to the Bureau of Labor Statistics, pallet prices began rising in January significantly and spiked over the summer. See Chart 1.

Major price inputs from lumber and cores to labor, transportation and nails all suffered major price hikes this year. As demand increased earlier in the year, customers went scrambling looking for supply. This includes both used and rental customers looking for options from new pallet manufacturers. White explained that pallets that would usually get scrapped were repaired and put back into service.

Will any of these factors change in 2022? Elevated salaries are not likely to go down. Lumber prices will probably come down at some point in 2022. But how much and when is anybody’s guess. Transportation isn’t likely to get much better except fuel becoming a little more affordable. Probably, the only way that the transportation crunch eases is a recession.

The recycled pallet market may get a bit better in January as holiday shipments are moved off pallets. But there may not be a big Christmas flush of pallets form distribution centers as in years past. Core supplies remain tight with new pallets being sold to recycled customers. The big problem is that these new pallets are designed to be as cheap as possible, which will continue to depress core quality on the market.

As interest rates rise in 2022, money may become a bit more expensive, which could cool some of the merger and acquisition activity. But given the deep pockets of the equity players eyeing the pallet market, the interest rate changes aren’t likely to be enough to stand in the way of the right strategic deals.

My advice is free, so it may not be worth much. But I think we will see more of the same on many of these key trends although the price spikes and shortages may lessen somewhat.